Employees' Provident Fund Health Treatment Scheme will be Effective from 1st Falgun 2080

The Employees Provident Fund (EPF), known as Karmachari Sanchaya Kosh in Nepal, has recently announced a significant enhancement to its healthcare services. Starting from the 1st of Falgun 2080, the fund will extend health care benefits to the spouses of its contributors, marking a considerable expansion in its service offerings.

EPF has been a cornerstone in providing financial security and healthcare benefits to its members. Since 2076, the fund has offered medical coverage up to Rs 1 lakh annually for minor illnesses requiring hospitalization. For more severe, life-threatening conditions, the fund has provided up to Rs 10 lakh throughout the service tenure of its members.

Inclusion of Spouses in Health Plan:

Jitendra Dhital, the administrator of the fund, has underscored this expansion. The inclusion of members' spouses into the healthcare scheme is set to commence from Falgun 1, 2080. This initiative is expected to bring considerable relief to the families of the contributors, ensuring more comprehensive health coverage.

Regulatory Revisions and Hospital Network Expansion:

The adoption of the 'Employee Provident Fund, Social Security Scheme Operation Regulations, 2080' in Poush 2080 has paved the way for this broadening of healthcare services. Notably, the regulations have also updated the list of hospitals eligible for medical treatment under this scheme. Now, healthcare support from the fund is available only for treatments at hospitals recognized in the regulation's list.

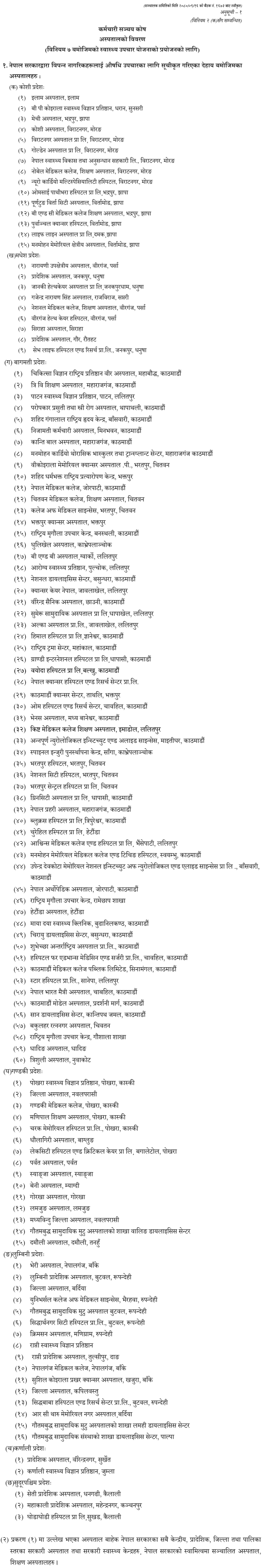

Eligible Hospitals and Treatment Facilities:

Currently, this healthcare benefit covers treatments in central, provincial, district, and municipality-level government hospitals, hospitals owned by the Government of Nepal, and all teaching hospitals. The fund specifies that treatment must be at one of the 120 hospitals listed in the regulations for the research admission to apply.

Treatment Categories and Coverage:

The fund categorizes diseases into common and fatal, with corresponding coverage levels. For common diseases, up to Rs 100,000 is available per financial year. In contrast, for 12 types of fatal diseases, a maximum of Rs 100,000,000 is offered throughout the service period. Covered fatal diseases include cancer, heart attack, stroke, kidney issues, and other serious conditions.

Claim Process and Timeframes:

To claim healthcare benefits, a minimum of six months of fund contributions is required, and the claim must be submitted within two months of hospital discharge. In the unfortunate event of a patient's death, the claim period is extended to three months.

Healthcare Facility Implementation and Management:

EPF's healthcare facilities have been operational since 2070. Initially managed through Rashtriya Bima Company Limited from 2075 Mangsir, the fund took over direct management of the health care program from 2076 Mangsir. As of 2080 Falgun 1, all social security programs by the fund will adhere to unified regulations.

Financial Support and Subsidies:

In the 2079/80 financial year, the fund provided substantial healthcare services, with financial support extended to numerous depositors for both common and fatal diseases. Additionally, EPF has supported its members through the Kazkiria subsidy scheme and the maternity and infant care scheme. Accident compensation support has also been provided to several depositors.

The Employees Provident Fund's expansion of healthcare services reflects its commitment to enhancing the welfare of its members and their families. This development not only broadens the scope of available medical support but also strengthens the safety net provided to contributors, showcasing EPF's dedication to upholding the financial and health security of its community.